Marina Bay Sands Expo and Convention Centre, Singapore

10 Bayfront Ave, Singapore 018956

Risk Live Asia is an exceptional, vibrant and probably the biggest gathering of Risk Management colleagues across Asia. The agenda and the speakers were power packed and provided valuable insights on critical topics which one can deliberate at their work. Looking forward to be back at Risk Live Asia 2026.

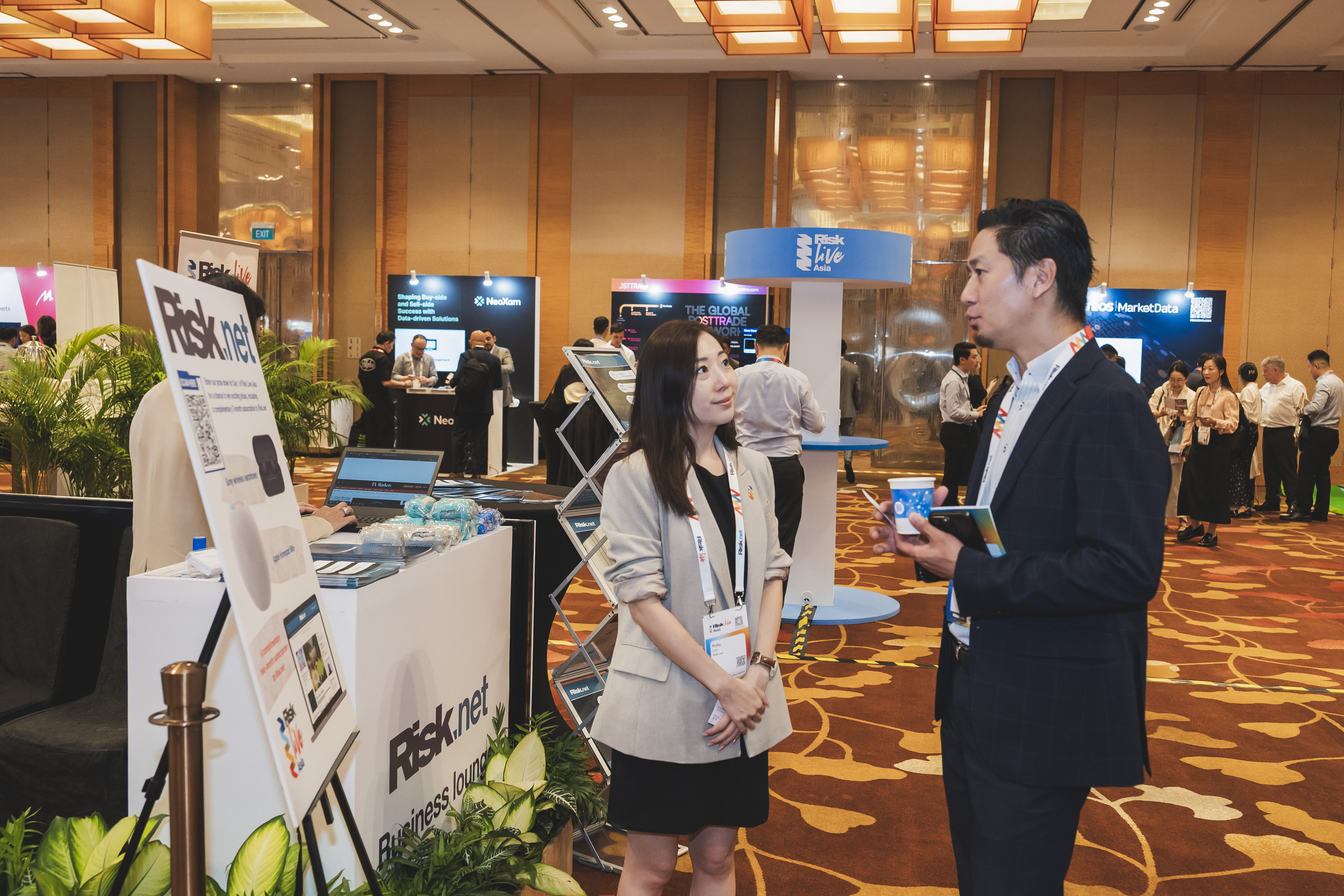

Risk Live Asia 2025 was an incredible opportunity to connect with leading risk professionals across the region

Risk Live Asia has evolved impressively from the early days of Asia Risk Congress. The panels featured progressive topics such as AI applications in trading and forward-looking stress testing, making the discussions highly engaging.